Global economic growth is slowing. There is a global manufacturing recession already in place: the latest surveys of economic activity in the major economies show that there is an outright contraction in manufacturing in all the major economies – and it is getting worse.

US ISM manufacturing index (score below 50 means contraction)

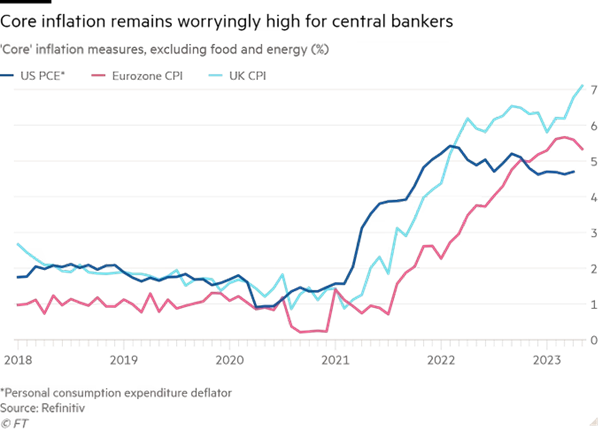

But inflation of prices outside of food and energy, the so-called core inflation rate, is not falling in the major economies.

Central bank chiefs continue to shout the mantra that interest rates must rise to reduce ‘excessive demand’ in order to get demand back in line with supply and so reduce inflation. But the risk is that ‘excessive’ interest rate hikes will accelerate economies into a slump before that happens and also engender a banking and financial crisis as indebted companies go bust and weak banks suffer runs on their deposits.

The stock markets of the world…

Ver la entrada original 2.515 palabras más